The ART© of Transformation

(Accelerated, Risk-based Transformation)

ART© is designed to facilitate and accelerate operational transformation as an iterative process with a risk-based methodology and by adopting established concepts such as operational risk assessment, underwriting appetite or investment management strategies. ART© has been initially designed as a response to the digital transformation gap in the (re)insurance sector, also amplified by difficulties to integrate new options from insurtechs in insurance core processes. ART© can easily be adapted to any other area and/or industry.

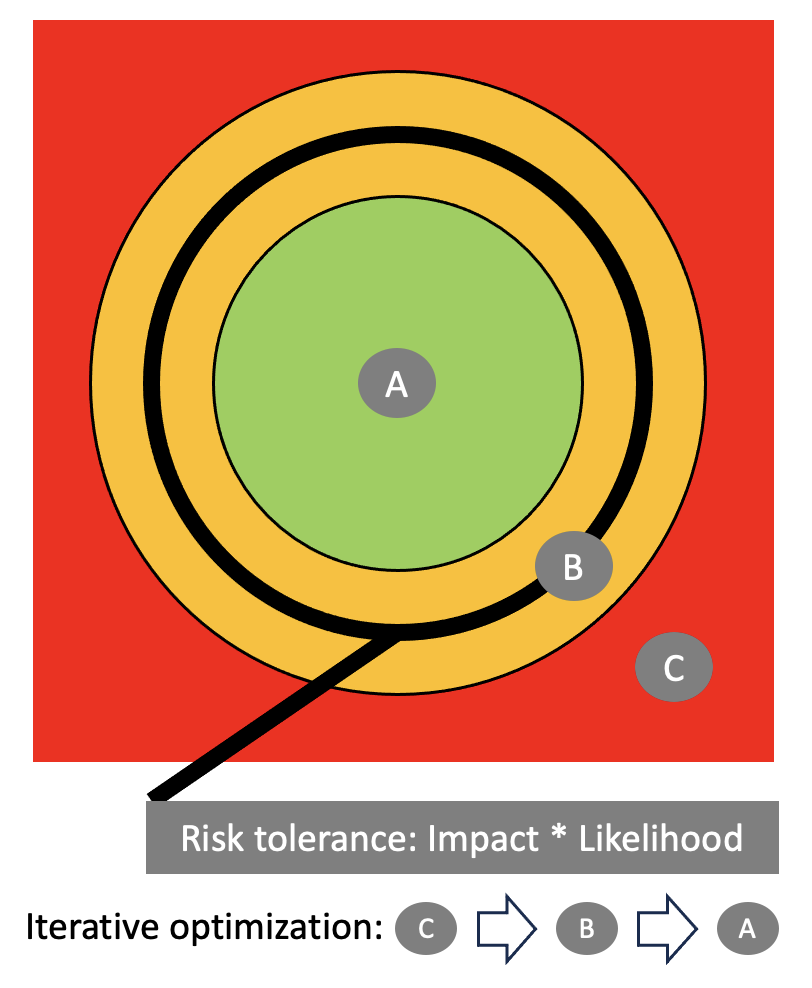

How to take and actively manage transformation risk?

Goals of iterations:

Optimize risk tolerance

Increase number of transactions in cluster A

Reduce issues and efforts for cluster B

Develop solution for remaining cluster C (post-transformation)

Sensitize ecosystem to ongoing transformation

Move from culture of failure to risk culture

"Learn to walk before you run"

Iterative steps (standard):

Agree on risk tolerance with management

Define parameters for risk clusters A, B and C

Prepare reactions for detected issues in cluster B

Apply target solution over defined period

Track & manage cluster B; spot-check cluster A & C

Quantitative and qualitative review for all clusters

Optimize target solution

Copyright © 2024 by Oaswiss AG

Example: Automated e-mail response by using CompanyGPT